The rapid modernization of power infrastructure in Southeast Asia and Africa has sparked unprecedented demand for All-Dielectric Self-Supporting (ADSS) cables, a critical component for integrating communication networks with electricity grids. As governments and utilities prioritize renewable energy integration, rural electrification, and smart grid development,

ADSS cables are emerging as the backbone of cost-effective, future-ready solutions. This article explores the drivers behind this surge, market opportunities, and strategies for stakeholders to capitalize on this booming sector.

1. Why ADSS Cables? Key Drivers in Emerging Markets

A. Power Grid Expansion & Renewable Energy Projects

Southeast Asia:

Countries like Vietnam, Indonesia, and the Philippines aim to achieve 95%+ electrification by 2030. ADSS cables are deployed alongside high-voltage transmission lines (up to 500kV) to enable real-time grid monitoring and control.

Solar/wind farms in remote areas rely on ADSS cables for data backhaul. Example: A 500MW solar plant in Thailand reduced operational costs by 30% using ADSS-based monitoring systems.

Africa:

Megacities like Lagos (Nigeria) and Nairobi (Kenya) are upgrading aging grids. ADSS cables cut deployment time by 50% compared to underground alternatives.

Cross-border projects, such as the Eastern Africa Power Pool, leverage ADSS cables for their anti-corrosion and lightning-resistant properties.

B. 5G and Smart Grid Synergies

ADSS cables provide dual-purpose infrastructure: power transmission + high-speed fiber backhaul for 5G and IoT networks.

2. Competitive Advantages of ADSS Cables

A. Cost-Efficiency and Durability

Zero Electromagnetic Interference: Non-metallic design allows installation close to high-voltage lines without risk of short circuits.

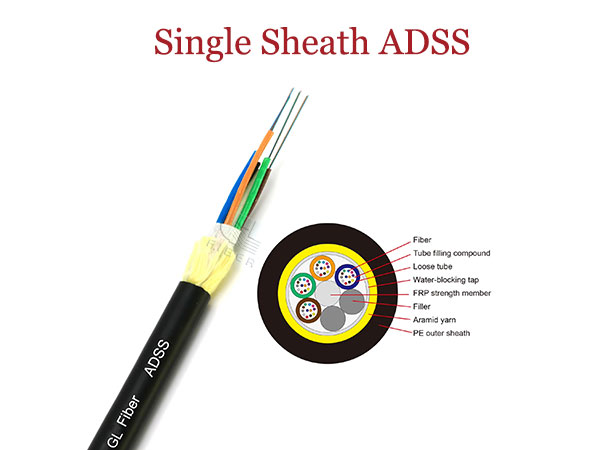

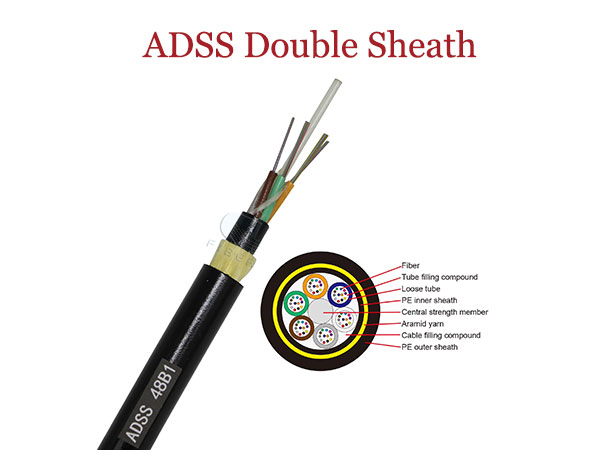

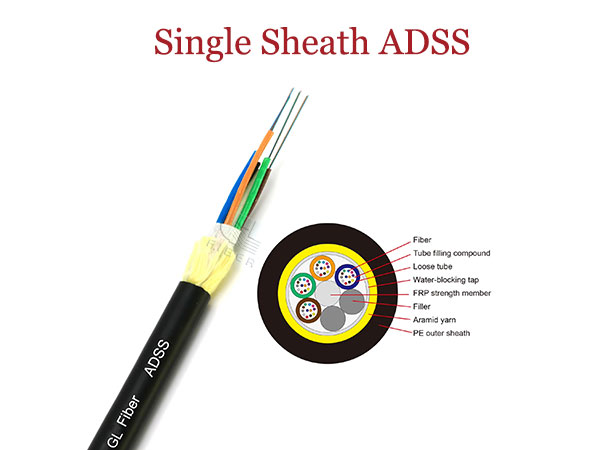

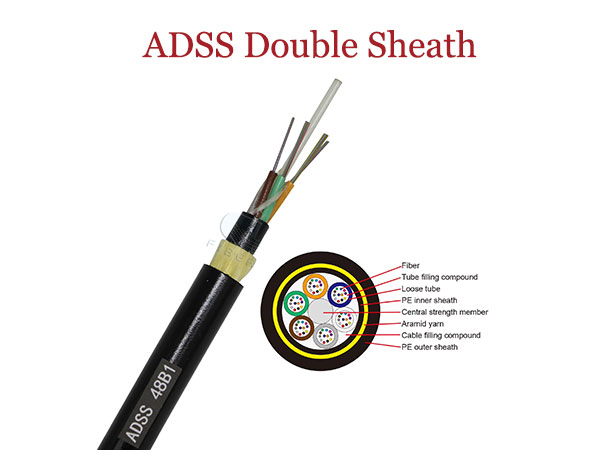

Lightweight & High Tensile Strength: Aramid yarn reinforcement enables spans up to 1,500 meters, ideal for mountainous or island terrain.

30-Year Lifespan: UV-resistant PE/AT sheaths withstand extreme climates (heat, humidity, sandstorms).

B. Installation Flexibility

No Power Outages Required: Deploy on live transmission lines, minimizing disruptions.

Lower TCO (Total Cost of Ownership): Reduced maintenance costs offset higher upfront material expenses.

3. Market Opportunities: How to Capture Growth

A. Localized Manufacturing Partnerships

Case Study: A Chinese ADSS supplier partnered with Vietnam’s EVN to build a local factory, tailoring cables for tropical climates and securing 35% market share.

B. Customized Solutions for Regional Challenges

Coastal Areas: Anti-salt spray coatings for Southeast Asian archipelagos.

Arid Regions: Enhanced abrasion resistance for African deserts.

C. Policy Alignment

Certify products to IEC 60794 (common in ASEAN) and IEEE 1138 (favored in Africa).

Leverage government incentives, like Indonesia’s tax breaks for smart grid projects using ADSS cables.

4. Challenges and Strategic Responses

A. Supply Chain Optimization

Establish regional material hubs in Southeast Asia to reduce lead times.

Use multimodal logistics (rail + sea) to bypass African port bottlenecks.

B. Skills Development

Offer certified ADSS installation training programs. Example: A Kenyan project reduced fault rates from 15% to 3% through technician upskilling.

C. Combating Price Competition

Highlight ADSS’s long-term ROI: 60% lower lifecycle costs vs. traditional cables.

5. Future Trends: Innovation in ADSS Technology

Smart ADSS Cables: Integrate distributed temperature sensors (DTS) for real-time grid health monitoring.

Eco-Friendly Materials: Develop bio-based sheaths to meet EU sustainability standards and tap export markets.

Conclusion: Seizing the ADSS Boom

Southeast Asia and Africa’s power grid expansion represents a $10B+ opportunity for

ADSS cable suppliers. Success hinges on localized solutions, agile supply chains, and educating buyers on lifecycle value. For utilities and telecom operators, adopting ADSS technology is a strategic move to future-proof infrastructure while accelerating electrification and digitalization goals.